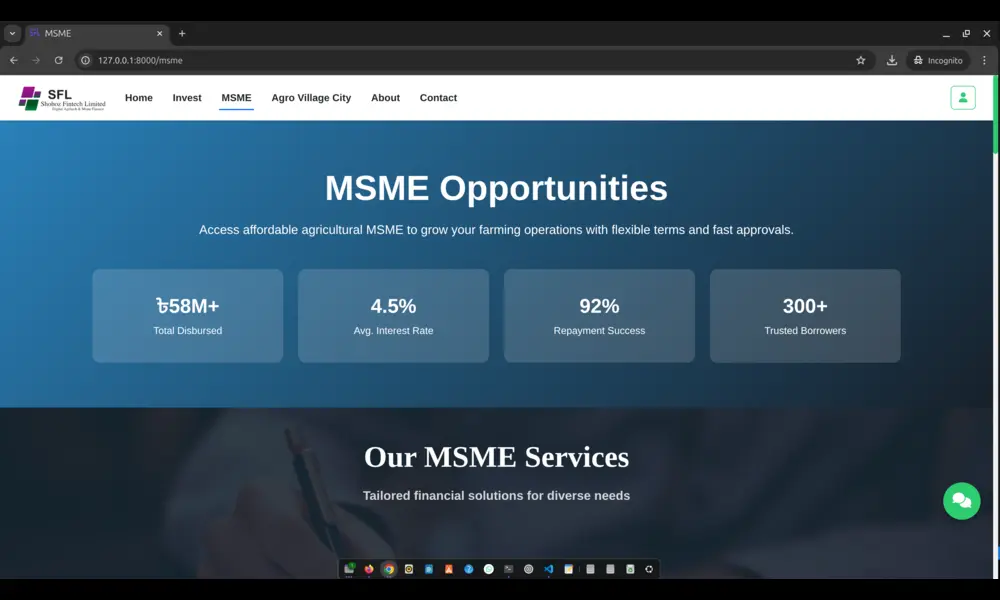

MSME Opportunities

Access affordable agricultural MSME to grow your farming operations with flexible terms and fast approvals.

Our MSME Services

Tailored financial solutions for diverse needs

Why Choose SFL MSME

Experience hassle-free borrowing with our customer-centric loan services

Quick Approval

Get loan approval within 24-48 hours with our streamlined application process and minimal documentation.

Competitive Rates

Enjoy some of the most competitive interest rates in the market with transparent pricing.

Flexible Terms

Choose repayment periods from 3 months to 5 years based on your financial capacity.

Minimal Paperwork

Simple documentation process with most verifications done digitally for your convenience.

No Hidden Charges

Clear upfront disclosure of all fees with no surprises during the loan tenure.

Dedicated Support

Personalized assistance throughout your loan journey from our customer service team.

Simple Loan Process

Get funded in just a few easy steps

Sign Up

Create your account on our platform by providing basic details and verify your identity to get started.

Submit Loan Application

Fill out a quick online application form with your financial and personal details to initiate the loan process.

Get Pre-Approval

Our team reviews your application and provides a preliminary loan approval based on your eligibility.

Submit Required Documents

Upload or provide the necessary documents, such as ID, proof of income, and bank statements, for final approval.

Receive Loan Offer

Once approved, review and accept the loan terms and conditions to proceed with disbursement.

Loan Disbursement

After acceptance, receive the loan amount directly into your bank account. You're now ready to use your loan!

Watch Our Loan Process

Learn how Shohoz Fintech simplifies the loan process to provide you with quick and secure financial solutions.

View DemoWhere Our Loan Funding Comes From

Transparent and sustainable funding sourced from trusted agricultural and farming projects.

Funds from Cattle Farming Projects

We source loan funds from carefully managed cattle farming projects, where livestock is bred and raised for sustainable production. These projects ensure both short and long-term profitability, supporting local farmers and contributing to the economy.

Funds from Fish Farming Ventures

Our loan funds are collected from eco-friendly fish farming ventures. These sustainable aquaculture projects ensure high returns while minimizing environmental impact, supporting the growth of Bangladesh's aquaculture industry.

Funds from Goat Farming Projects

We source loan funds through goat farming projects, where local farmers breed goats for both meat and dairy. This initiative helps improve the livestock sector, supporting both rural development and Bangladesh's agricultural economy.

Funds from Agricultural Crop Production

In addition to livestock, loan funds are collected from crop farming projects. These include organic and sustainable farming practices that support food production, ensuring economic growth and contributing to Bangladesh's agricultural sector.